<<

Back to Asia Next

Akarsh Dhaiya

Mar '22

Localization is a complicated process, and factoring in the diverse audience of Asia makes it an even bigger nightmare! Asian economies add one more level of complexity — they all are at different stages of maturity. So, a strategy that might have worked in one nation might fall flat in another.

In a world with options, your relationship with your market segment defines your profitability. Companies go to great lengths to maintain their customer-preferred status, for instance -

Let’s look at a local player that took this to another level.

Grab started as a ride-hailing startup, like Uber, in 2012. And rather than trying to scale quickly and take on the global giant Uber, Grab optimized to strengthen its foothold in Southeast Asia.

Recognizing the Power of Cash

The credit card payment model of Uber became flawed when it came to Southeast Asia, where along with the absence of credit cards, a majority of the population is ‘unbanked’.

In Southeast Asia, the majority of the countries have less than 5% population with access to a credit card.

Grab countered this by including cash payments in their model from day one. It eventually launched GrabPay, which allowed it to enter into e-Commerce, FinTech, and other ventures. The platform lets users pay and receive payments for its services, pay bills, and purchase items in-store combined with a loyalty-rewards program. Uber also failed to address that many local drivers did not know how to use a smartphone, making the Uber app inaccessible to them.

In-House Solutions & Partnerships

What started as a mobility service platform quickly addressed local problems and successfully diversified to food delivery services, on-demand video platforms, ticket purchasing, grocery shopping, hotel booking services, and financial services.

Grab’s Service Portfolio

Along with its in-house solutions, Grab partnered with VOD streaming platform HOOQ, Booking.com, Agoda, and BookMyShow to grow its portfolio.

Dodging the heavy traffic and long jams

The local player also addressed the traffic and long jams of the Southeast Asian cities through Grab Bike. Grab Bike helped weave out of heavy traffic and cut through Uber’s taxi model.

Grab All-in!

To further its reach, Grab

Summarizing Grab’s Milestones

To conclude: The hyper localization strategy of Grab made the users so dependent on its service that it was practically impossible for the other competitors to get the attention of these users. Well funded and practically infinite resource-rich Uber could not compete with Grab in Southeast Asia. In 2018, Grab acquired all of Uber’s assets in the region in return for a 27.5% share in its company.

Asia is a place where your ‘BEST’ technology becomes ‘BETTER’. If you think your product is unique and cannot be copied -you are in illusion. And as the product options and access points for customers proliferate across sectors, a new challenge is emerging for global players.

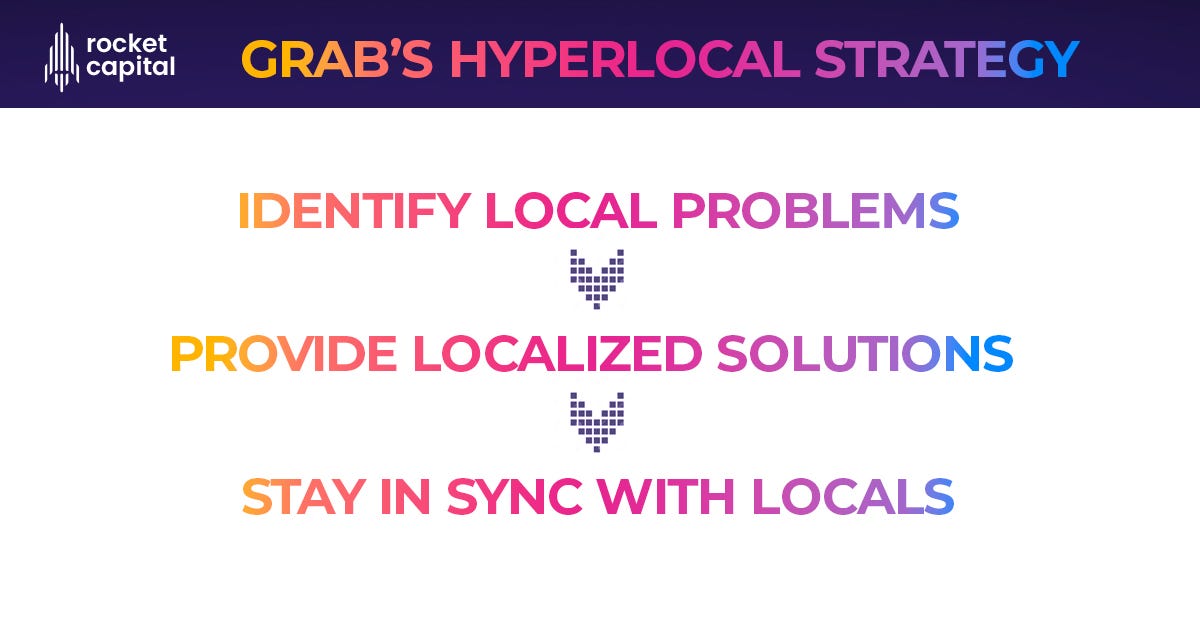

With the advantage of being a home-grown brand, the Asian firms are entering into complementary markets to reach new customer bases. Flipkart, for example, has made 19 acquisitions and 23 investments. The company has spent over $ 395M acquiring, entering more verticals, and integrating more services. The best shot that global players have is through HYPER LOCALIZATION which involves -

And, if your product still has poor market acceptance, it is also important to know — When to give up and explore alternatives. So, did Uber really fail in Southeast Asia?

Asia Next is a vlog and blog series about challenges & opportunities faced by global companies, and the Go-To-Market(GTM) strategies Rocket Capital has curated to make your navigation through the landscape easier. With a massive investor network and strong connections in the industry, we help Founders fulfill their Asian Ambitions.

Rocket Capital is a VC fund investing in New Media Technology start-ups globally. We invest in pre-Series A, Series A & B companies and help founders scale in Asia.