<<

Back to Asia Next

Akarsh Dhaiya

Feb '22

My passion for Go-To-Market(GTM) strategies for Asia began 11 years ago when I started my first job. I spent 7 years of my life successfully expanding a B2C Fintech product in 15+ markets. I have learned a lot during this process, but the most important learning has been — This geography is so complex, dynamic, and rewarding that you can spend a lifetime carving the right path. That’s why I decided to launch this Asia Next Series, a compilation of my experiences and the experiences of industry leaders via vlogs and blogs, trying to distill signal from noise.

This vlog and blog series is not about building a product. If your product sucks, this is not a place to get product advice. The objective of this series is to help your DISTRIBUTION ONLY.

How do we make this navigation smooth? It’s an everyday conversation at Rocket Capital. Mark del Rosario and I founded Rocket Capital, a VC firm investing New Media Technology sector, to invest in promising and scalable technologies to help them grow in Asia.

This article touches on three points:

Creating one “SINGAPORE” hub and expecting that it will cater to the entire APAC is a MYTH

Every country in APAC has its unique way of doing business, language, resources, consumer purchasing power, etc. India is very different from the Southeast Asian cluster, which is extremely different from China.

I am writing this strictly in reference to startups. Even if you are an awesome tech startup, your product needs a lot of experimentation in the new markets. So, it is not a great strategy or an expectation to open an office, hire 10 people, and expect these sales guys to crack an entire market for you. If I translate this in an EU context, you are opening an office in Paris, hiring french speakers, and expecting these sales guys to conquer the entire EU market. I would emphasize it again, Not a great strategy!

HYPER LOCALIZATION, HYPER LOCALIZATION, HYPER LOCALIZATION — That is the Mantra!

Every American brand that entered Asian markets had hyper localization as a key ingredient in its Asian GTM strategy. Google added multiple languages to accommodate the diverse audience, Amazon boosted the network of local sellers it had created to increase its already massive market share, KFC, the American fast-food chain, became a Chinese cuisine brand — infusing the versatile flavor palette of the Chinese consumer in their menu. KFC even tailored the ambiance to win over the Chinese consumers. McDonald’s, a brand that is a perfect example of the term glocal, went beef-free in India, where cows are considered sacred. Let us look more closely at some of the key strategies used.

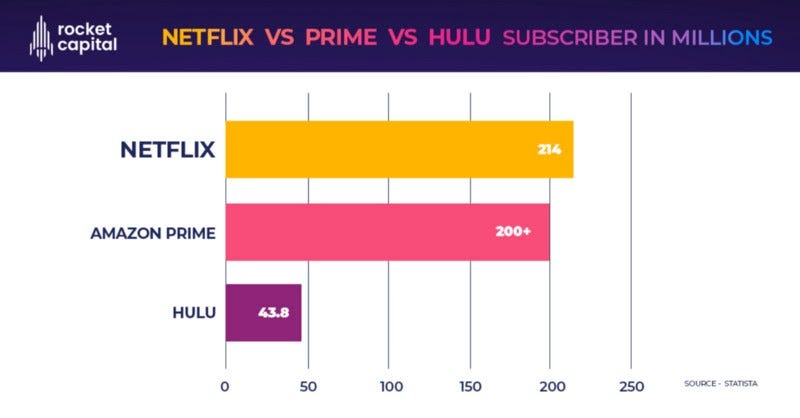

Netflix and Hulu (now acquired by Walt Disney) are massively popular streaming services. While Netflix and Prime flourished globally and banked on Asia, Hulu stayed put in its home country — losing a market of billions.

Netflix — Capturing Market through Localization

Netflix realized very early on that Asia is a price-sensitive and content-specific market. The streaming giant modified its strategy massively to accommodate the Asian audience by

Netflix has picked up and purchased exclusive rights to many TV series. The company provided an opportunity to many local players for producing globally viral content and the best example of this is — Squid Game. For 10 years Squid Game was rejected by many studios until Netflix picked it up. According to Bloomberg, the series is expected to add over $900 million to the company’s value.

Netflix Subscribers

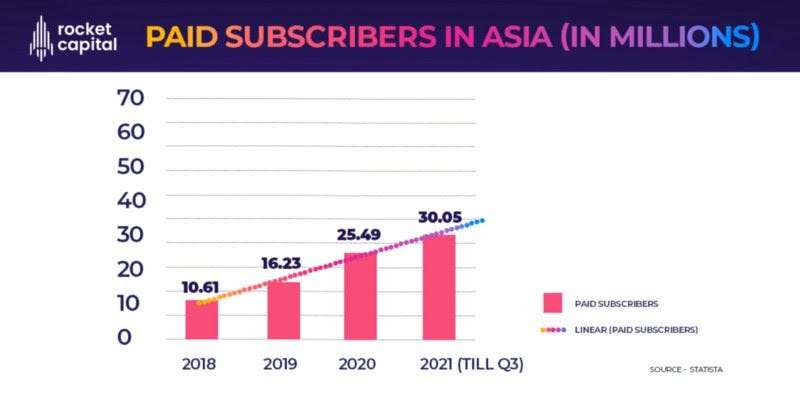

From 99 million subscribers worldwide in 2017, Netflix grew to about 214 million subscribers in 2021, of which 30.4 million are from the APAC region. The APAC region is projected to grow 65M+ in the next five years.

To ride the next big wave through the Asian landscape, you’ll need a power-packed strategy and its impactful execution. In this blog series, I’ll explore the ingredients needed to expand in Asia and how different technology companies evolved by incorporating specific business expansion strategies into their business models.

Here is a quick checklist.

In the upcoming series, I’ll explore the businesses that got crushed in Asia — the pitfalls they should have avoided, the ‘one’ business strategy that works every time, the rewards of Asia, and all things you need for your Asia Next expansion strategy. So, stay tuned.

Asia Next is a vlog and blog series about challenges & opportunities faced by global companies, and the Go-To-Market(GTM) strategies Rocket Capital has curated to make your navigation through the landscape easier. With a massive investor network and strong connections in the industry, we help Founders fulfill their Asian Ambitions.

Rocket Capital is a VC fund investing in New Media Technology start-ups globally. We invest in pre-Series A, Series A & B companies and help founders scale in Asia.